Account Types

MARGIN & LEVERAGE RULES

- LEVERAGE OPTION FROM 1:100 UP TO 1:3000. At Bold Prime, all clients enjoy the flexibility to trade with consistent margin requirements and leverage ranging from 1:100 to 1:3000

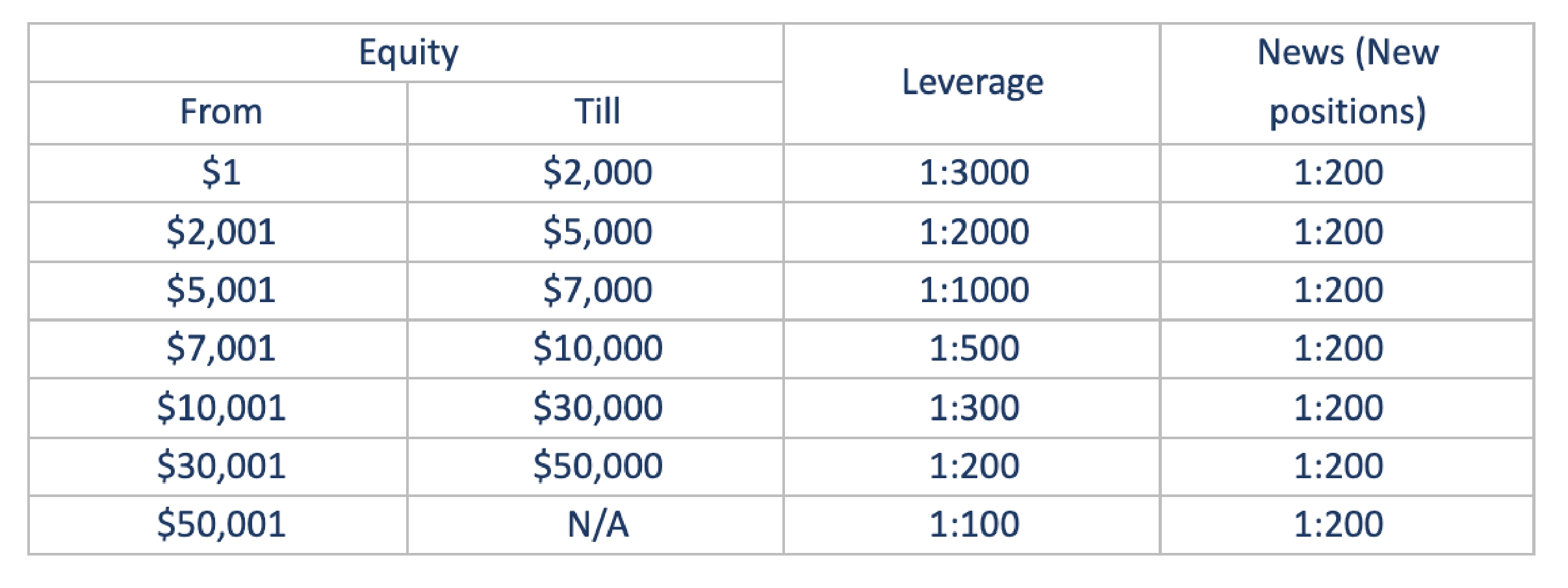

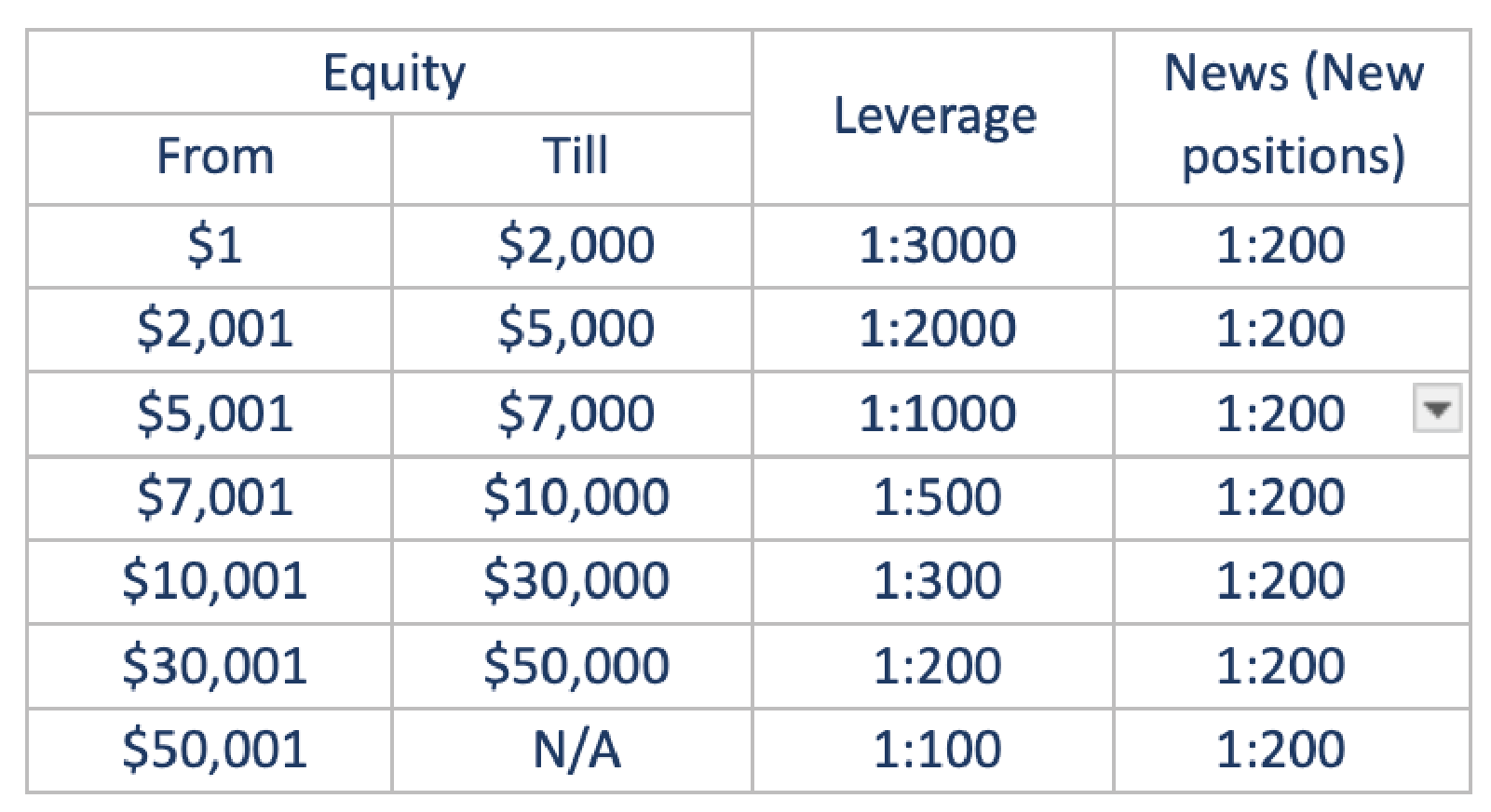

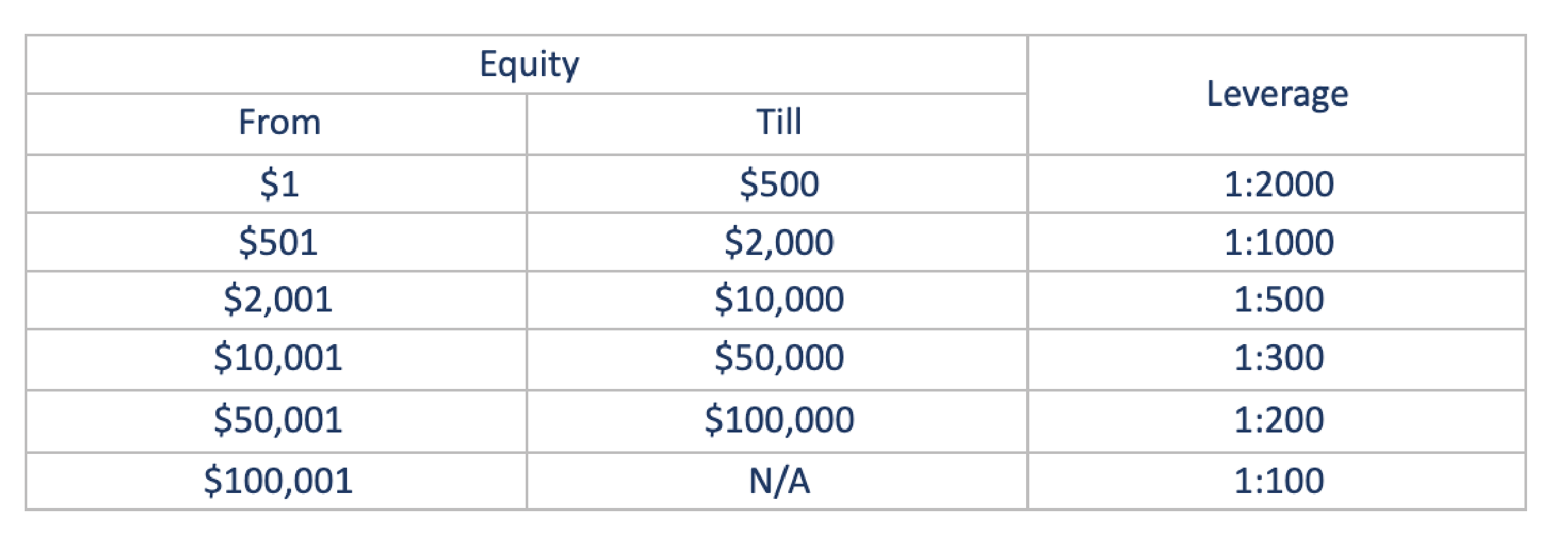

- BOLD PRIME LEVERAGE. At Bold Prime, the leverage you can select varies depending on the account type, ranging from 1:100 to 1:3000. Margin requirements remain constant throughout the week and do not increase overnight or on weekends. However, leverage may be temporarily reduced for existing and new positions opened within 5 minutes before and 15 minutes after significant news events only if a new position opened during news-time, leverage will revert back to the Prime Max account leverage after this period. Margin for positions opened during news time will be maintained. Additionally, you can adjust your leverage, either increasing or decreasing it, by request (Change Leverage Application) or contacting our customer support team at [email protected].

- ABOUT LEVERAGE. Leverage allows you to trade positions larger than your account balance by using borrowed funds. It is represented as a ratio, such as 1:500, 1:1000, or 1:3000. For example, if you have $100 in your account and trade a lot size of 50,000 EUR/USD, your leverage would be 50:1. At Bold Prime, you receive a free short-term credit allowance when trading on margin, enabling you to initiate transactions that exceed your account value. Without leverage, your trading is limited to the funds in your account. Bold Prime reserves the right to adjust the leverage ratio (e.g., reduce the leverage ratio) at its sole discretion without prior notice, either on a case-by-case basis or across all or specific client accounts as necessary.

- LEVERAGE RISK. Using leverage allows you to generate significant profits from a relatively small initial investment. However, it also means that your losses can be substantial if you don’t implement proper risk management. Bold Prime offers a range of leverage options, enabling you to select your desired risk level. We advise against trading near a leverage of 1:3000 due to the associated high risk.

- ABOUT MARGIN. “Margin” refers to the required funds that a trader must deposit to open and maintain a leveraged position. The amount needed to open a new position, calculated as a percentage of the total trade size based on the leverage ratio. For instance, with 100:1 leverage, only 1% of the trade size is needed as margin.

- MARGIN MONITORING. With Bold Prime, you can effortlessly manage your real-time risk exposure by keeping an eye on your used and free margin. These two elements together make up your equity. The used margin refers to the amount of money that is currently being used to maintain open leveraged positions. This is the portion of your account equity that has been set aside as collateral for these positions. The free margin is available funds in a trading account to open new positions or maintain existing ones. It’s the difference between the account equity (total account value including unrealized profits and losses) and the margin used for open positions. You can use the free margin to open new positions or to cover any potential losses. “Margin Level” represent a percentage that indicates the health of a trading account, calculated as (Equity / Used Margin) * 100.

- MARGIN CALL. A notification indicating that the margin level has fallen below the required threshold. The trader must deposit more funds or close positions to bring the margin level back up. Bold Prime adheres to a strict margin call policy to ensure your maximum risk does not surpass your account equity. However, clients remain fully responsible for monitoring their trading account activity. If your account equity falls below 50% of the margin required to maintain your open positions, we will issue a margin call to alert you that your equity is insufficient to support your open positions.

- STOP-OUT LEVEL. The stop-out level is the equity threshold at which your open positions are automatically closed, set at 30% in our system. It is solely the clients’ responsibility to maintain their account balance and prevent stop-out situations.

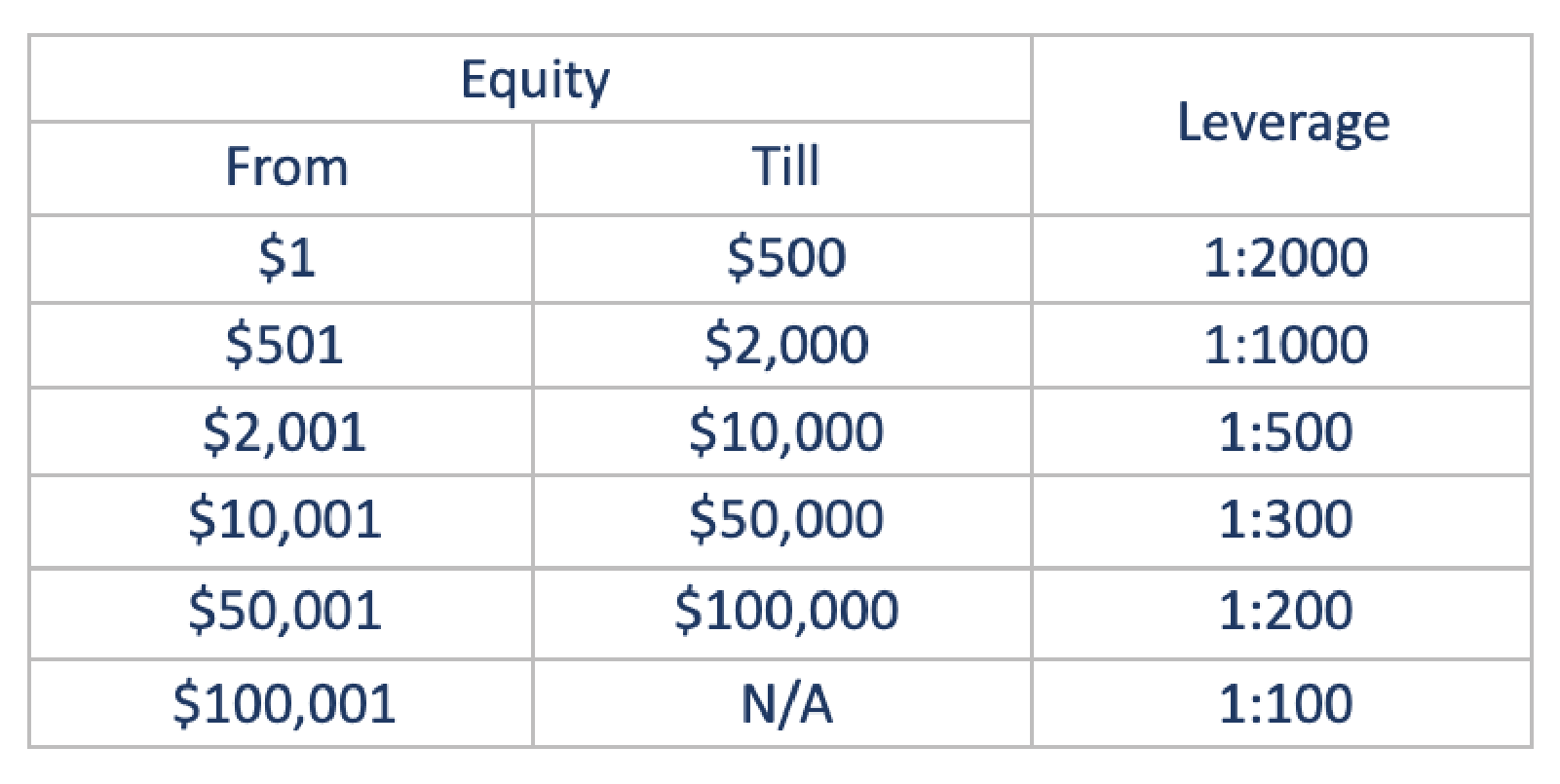

Bold Prime Standard Account Leverage

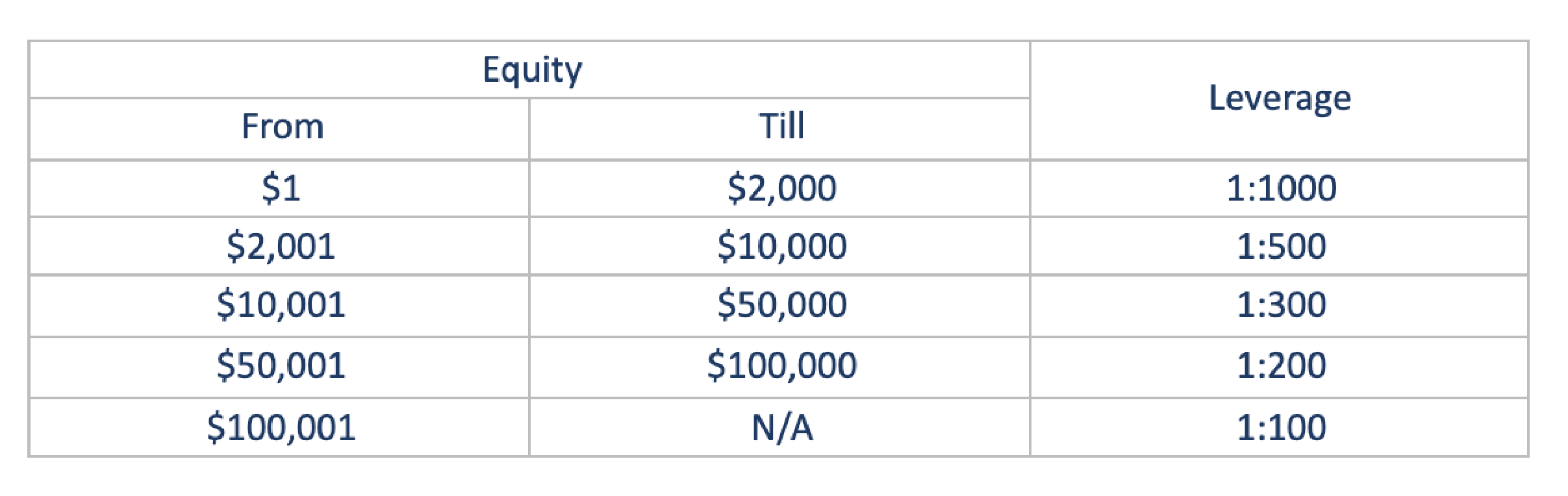

Bold Prime Bonus Account Leverage

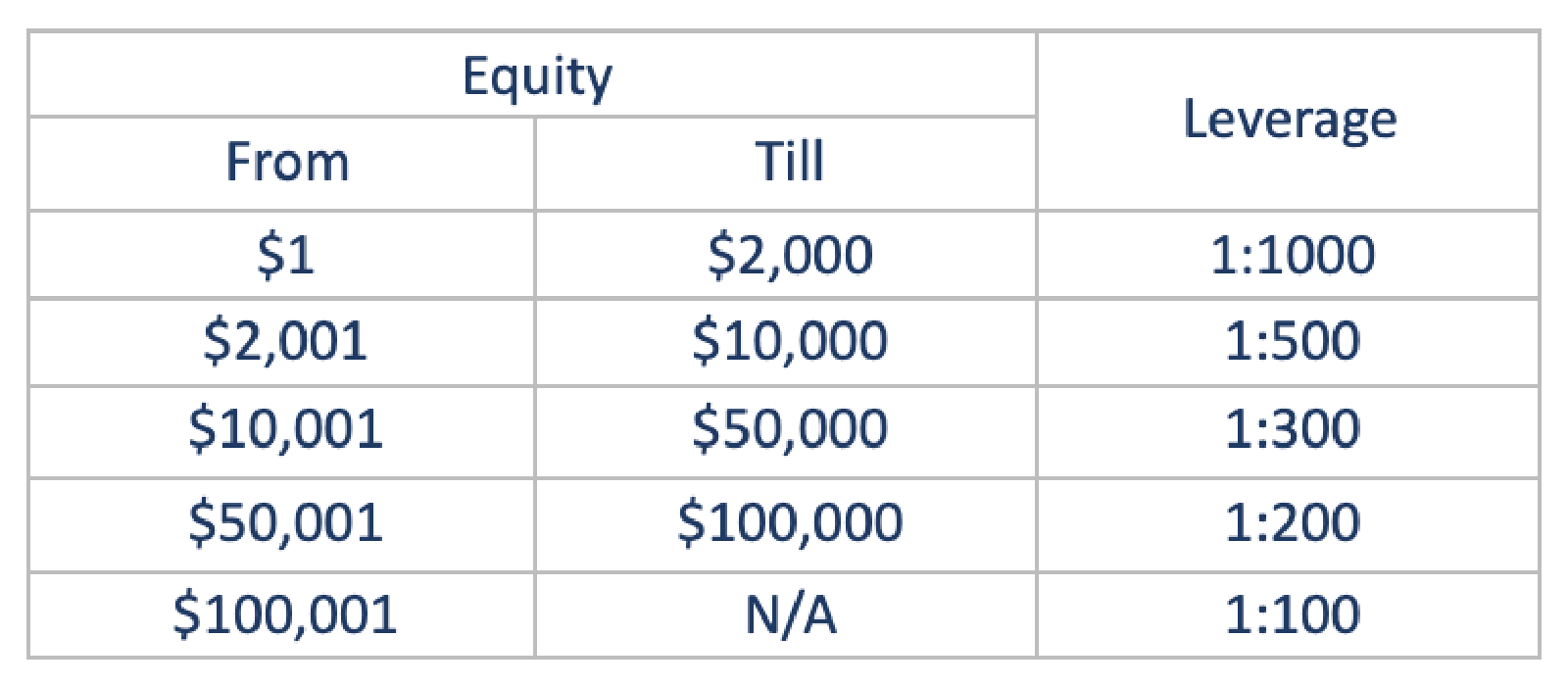

Bold Prime ECN Account Leverage

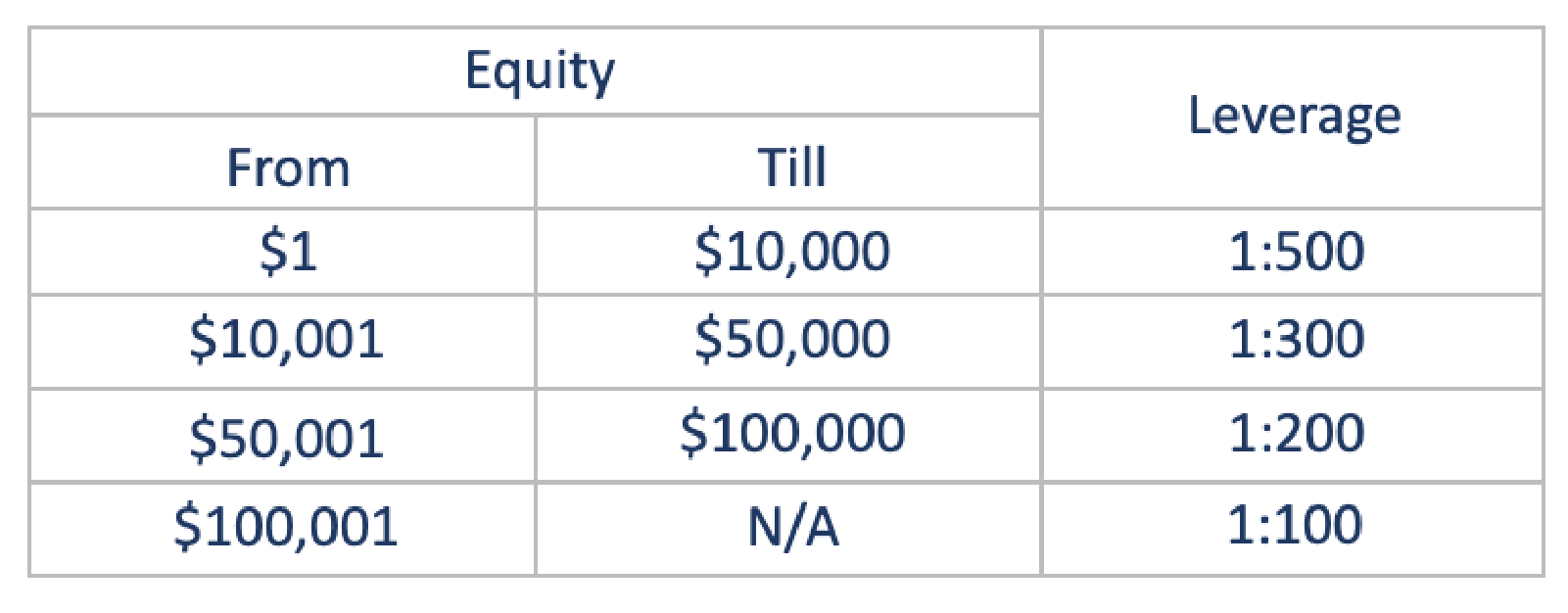

Bold Prime Max Account Leverage